Are we drifting towards a one size longevity assumption that doesn’t fit any?

Much has been made of the peaks and troughs of high street clothing retailers. Whilst many would say that the odds are stacked in favour of online operators, a hidden cost that e-commerce has been battling with for some time is the drain on profits driven by customers returning ill-fitting garments. Millions are spent each year, either at the manufacturing stage to produce easy-fit items, or on the website front-end to find technical solutions that help customers choose the optimum size.

The pensions industry is at a similar juncture, switching

out antiquated practices in favour of new technology that offers unrivalled

efficiency. Careful consideration and communication regarding an appropriate

framework for setting mortality assumptions under any new fast track funding

approach is crucial. Otherwise, there is a significant risk that the good work

done by many pension schemes to date to adopt evidence based, scheme specific

mortality assumptions (in line with previous tPR guidance) will be undone in

favour of a “one size fits all” assumption. The consequences of a mismatch in

our industry are much greater than simply having to return that bargain which definitely would have fitted before the lockdown

gym closures.

The longevity gap: worsening in the wake of COVID-19

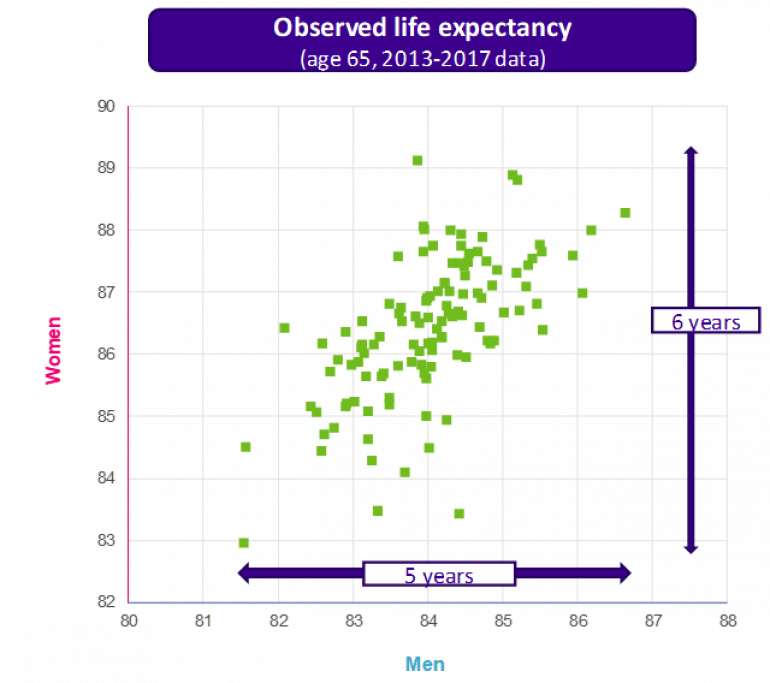

Whilst most pension schemes weather the storm of interest rates and inflation with a similar impact on their liabilities, membership factors such as income, lifestyle, health, education, and geography can lead to very significant differences in life expectancy – in excess of 10 years at age 65. Across the schemes in Club Vita we find this is equivalent to over 5 years difference in the baseline life expectancy at age 65 alone. In current times of negative net discount rate this is equivalent to over 20% difference in liabilities. This sensitivity is many times the difference between the top and the bottom end of the proposed range for the Fast Track low dependency discount rate.

Any attempt to prescribe a narrow range of mortality assumptions under the low dependency fast track approach, for example a standard mortality table, will fail to capture this variation - bad outcomes would then be inevitable. Pensions schemes with longer lived pensioners would be funding to too low a level, leading to material funding strains emerging over time; or worse, going undiscovered until the failure of the sponsor. Meanwhile, pension schemes with shorter lived pensioners risk unnecessarily high levels of funding and therefore cost to the sponsor. Furthermore, a disparity would be created between the approach taken by insurers when pricing longevity risk and the approach taken by pension schemes when funding for the same risk. At worst, this could see pension schemes intending to de-risk significantly underestimating the level at which their liabilities could be secured with an insurer.

Note: Chart relates to observed life expectancy i.e. based upon observed mortality rates for each scheme during 2013-2017

An alternative approach: already readily adopted across the industry

As a bare minimum, we hope tPR will require trustees to provide clear evidence under Fast Track that mortality assumptions are appropriate for their specific populations.

But in order to truly tackle longevity risk, any low dependency fast track basis should follow the path already taken by so many pension schemes, advisors and (re)insurers in the market (and also readily available to any yet to adopt) in adopting mortality assumptions based on the characteristics of the scheme membership following a member by member analysis.

In a world where quality tailoring was keenly priced,

readily available and already sported by your peers, who would risk being seen

in hand-me-downs?

Mark Sharkey, Head of Client Delivery

For and on behalf of Club Vita (UK) LLP

This is a summary

of Club Vita’s response to tPR’s consultation on the DB Funding Code of

Practice. The full consultation response is available on request by contacting mark.sharkey@clubvita.net.