The COVID-19 pandemic resulted in a significant rise in mortality rates in England & Wales in 2020. In order to avoid a significant fall in projected life expectancy, the CMI have refined their model to allow users to adjust the weight given to 2020 data.

9 March 2021

The CMI (‘Continuous Mortality Investigation’) has for a number of years produced annual updates to its Mortality Projections Model, which is the standard tool used by pension schemes and insurers to estimate future improvements in UK life expectancy. The CMI_2020 model has just been published, which includes population experience data up to 2020.

How the model works

The model uses population data from England & Wales to estimate future improvements in life expectancy. It first estimates the current mortality improvements (called the Initial Rate) from recent trends. These improvements are then assumed to evolve over time to eventually reach a Long-Term Rate of improvement. The Long-Term Rate is set by the user, who can also adjust the level of the Initial Rate (for example to reflect the pension scheme populations that the improvements are being applied to, which may have quite different characteristics than the general population underpinning the model).

How would the 2020 data impact the model?

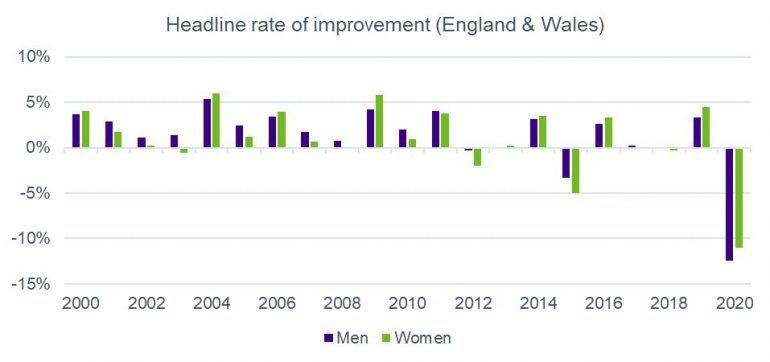

In a ‘normal’ year, CMI_2020, the latest version of the model, would be updated to reflect 2020 data. However 2020 was far from normal. The headline annual rate of improvement observed in the England & Wales population data was -12.4% for men and -11.0% for women (i.e. mortality rates increased significantly over the year). This was the biggest year-on-year increase since 1929, and resulted in mortality rates equivalent to 2008 levels.

Had this year fed through to the core calibration of the model, then projected life expectancies would have decreased significantly (cohort life expectancies at 65 would fall by around 1.2 years for men and 0.8 years for women1). This would be equivalent to a decrease of around 3% to 6% in Technical Provisions2.

Controlling the impact of 2020

Embedding the increase in mortality rates seen in 2020 into future projections would lead to negative improvements / increasing mortality year on year for most of the 2020s.

The CMI therefore, following consultation, introduced a new parameter in the CMI_2020 model which allows users to explicitly adjust the weighting given to the 2020 data. The core setting of the model places no weight on 2020, so it has no impact on the derivation of the initial rates.

The effect of effectively excluding 2020 experience in this manner is significant. While life expectancy is still lower than predicted under CMI 2019, it is only marginally so, by around 4 weeks for men and 1 week for women1. As a result, Technical Provisions would only fall very slightly, by less than ½%2. The slight fall is essentially due to the year in which the long-term rate is reached being 1 year later than under the CMI_2019 model.

Adjusting mortality improvements for pension schemes

The CMI encourages users of their Model to consider the population that improvements are being applied to when calibrating the model. Pension scheme members are typically healthier than the general population, and scheme liabilities tend to be dominated by the more affluent, less deprived individuals. Such individuals have been more resilient to the general slowdown in improvements seen in recent years. As such, pension schemes now typically use the ‘initial adjustment to improvements’ parameter of the CMI model to increase the initial rate above that obtained from population data.

This approach of adjusting initial rates is expected to continue. However, schemes will also be considering how to reflect the impact of the pandemic in setting mortality assumptions, as well as the more direct impact on pensioner payrolls of any increase in deaths in the scheme.

At this stage we suspect many schemes are likely to adopt a ‘wait and see’ approach through remaining on CMI_2019, or adopting CMI_2020 with no allowance for 2020.

However more sophisticated users may wish to revise their assumptions. In doing so, they will need to consider their views on how the pandemic is likely to evolve in the short, medium and longer term, and how their scheme’s characteristics will influence the impact of the pandemic (for example the socio-economic, and geographic, mix, as well as the age profile). In doing so, scenario analysis is a very useful tool as part of a pension scheme’s risk management framework.

At Club Vita we keep a close eye on the emerging statistics, and provide our member schemes with detailed analytics to enable them to make appropriate adjustments to the CMI model based on their mix of members.

References

1 Based on single life annuities with 0% net interest rate, at age 65 in 2021, using S3PM/FA base tables, with a 1.5% long term rate and otherwise core settings

2 Based on a life aged 65 in 2021, using S3PM/FA base tables, with a 1.5% long term rate and otherwise core settings

VitaMins: The CMI_2020 Mortality Projections Model

Download a print friendly version of this article